Congress to GAO: Follow the Medicare Advantage Money

A new bipartisan request targets how insurers may be funneling Medicare funds through owned providers—raising red flags about fraud, abuse, and $1.2 trillion in overpayments.

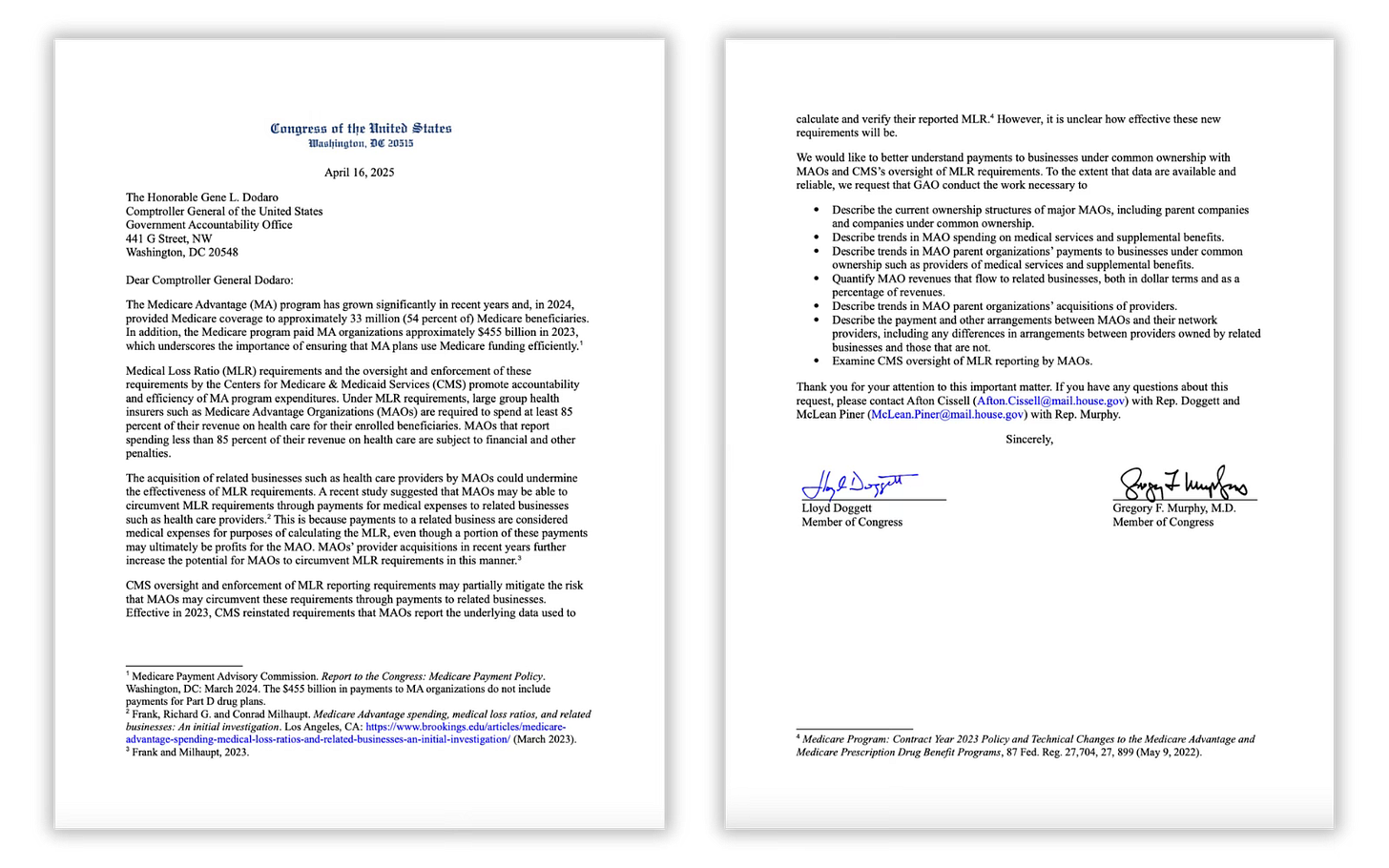

This month, a bipartisan lawmaker duo refocused their sights on Medicare Advantage – one of the most under-scrutinized — and overfunded — corners of our health care system. Reps. Lloyd Doggett (D-TX) and Greg Murphy (R-NC) sent a letter to the Government Accountability Office (GAO) – Congress’s independent, nonpartisan watchdog that is tasked with investigating how Uncle Sam's dollars are spent— requesting an investigation into whether MA insurers are exploiting their ownership of health care providers to pad profits and skirt federal rules.

This investigation request comes not a moment too soon.

Many big health insurers — including UnitedHealth, CVS/Aetna and Humana — now own or have close ties with the very physicians, clinics and providers they pay. When they “pay” those owned entities, they get to count those payments as medical expenses, even if the money stays inside the same corporate structure and ultimately boosts their bottom line.

Here’s the thing: that violates the intent of the Medical Loss Ratio (MLR) rule (established by Congress) that requires health insurers to spend at least 80% or 85% of their revenue on patient care (80% for individual and small group policies and 85% for employer-sponsored and other large group policies).

As the lawmakers wrote, this kind of self-dealing “could undermine the effectiveness of MLR requirements.” In simpler terms: Insurers can claim to meet those thresholds by moving money from their health plan subsidiaries to the subsidiaries that own and operate physician practices, clinics and pharmacy benefit managers. This isn’t accidental. It’s strategic.

The need for a GAO investigation becomes even more urgent when you consider just how much money is on the line.

According to the Committee for a Responsible Federal Budget, Medicare Advantage will be overpaid by a staggering $1.2 trillion over the next decade —largely due to two business practices: upcoding (making patients look sicker on paper to get higher payments from the government) and favorable selection (enrolling healthier people while making it harder for them to use care). These tactics pad the insurers’ bottom lines while threatening the solvency of the Medicare Hospital Insurance Trust Fund – and driving up premiums for all beneficiaries.

Let that sink in: Hundreds of billions of dollars in taxpayer funds meant to care for seniors could be ending up as profit for insurance companies. And hundreds of billions more could be extracted directly from seniors’ pockets through inflated premiums.

Congress has a chance to act — not just by investigating but by implementing smart, bipartisan reforms to stop the abuse of Medicare Advantage. Adjusting benchmarks, closing the upcoding loophole and enforcing stricter MLR reporting standards would be an excellent start.

Corporate meddling in Medicare Advantage is the greatest threat to the program’s integrity. Thanks to Reps. Doggett and Murphy, we may finally see some long-overdue scrutiny. But this will only work if the rest of Congress — and the public — pays attention to what the GAO finds.

It would also be helpful to stop MA agents from scamming older people on these plans. MA agents are very aggressive because they want to sell enough of the junk for lavish vacations and big bonuses.

Thank you for your success W. Potter.

Yes part C (MA) equals private for-profit health insurance corporations.