UnitedHealth Group's Q2 2023 earnings report shows billion dollar gains in pharmacy benefit business, tax-funded programs

Earlier this month, Wall Street was nervous that the big for-profit health insurers, which control access to medical care for most Americans–even those enrolled in Medicare and Medicaid–had paid more patient claims during the second quarter of this year than investors felt was appropriate.

Today, those investors are breathing a big sigh of relief–and are much richer than they were just last week.

UnitedHealth Group, the country’s largest health insurer by revenue, reported on Friday that, yes, the company did spend a little more paying claims between April and June than it did during the same quarter last year because of a post-pandemic uptick in the use of health care goods and services, out-patient care in particular. But it more than made up for it through additional money from taxpayers and a huge jump in revenue and profits in its vast Optum division, which encompasses UnitedHealth’s pharmacy middleman, Optum Rx.

Overall, UnitedHealth’s revenues increased by more than $12 billion, from $80.3 billion during the second quarter of 2022 to $92.9 billion during the same quarter this year, a 16% jump.

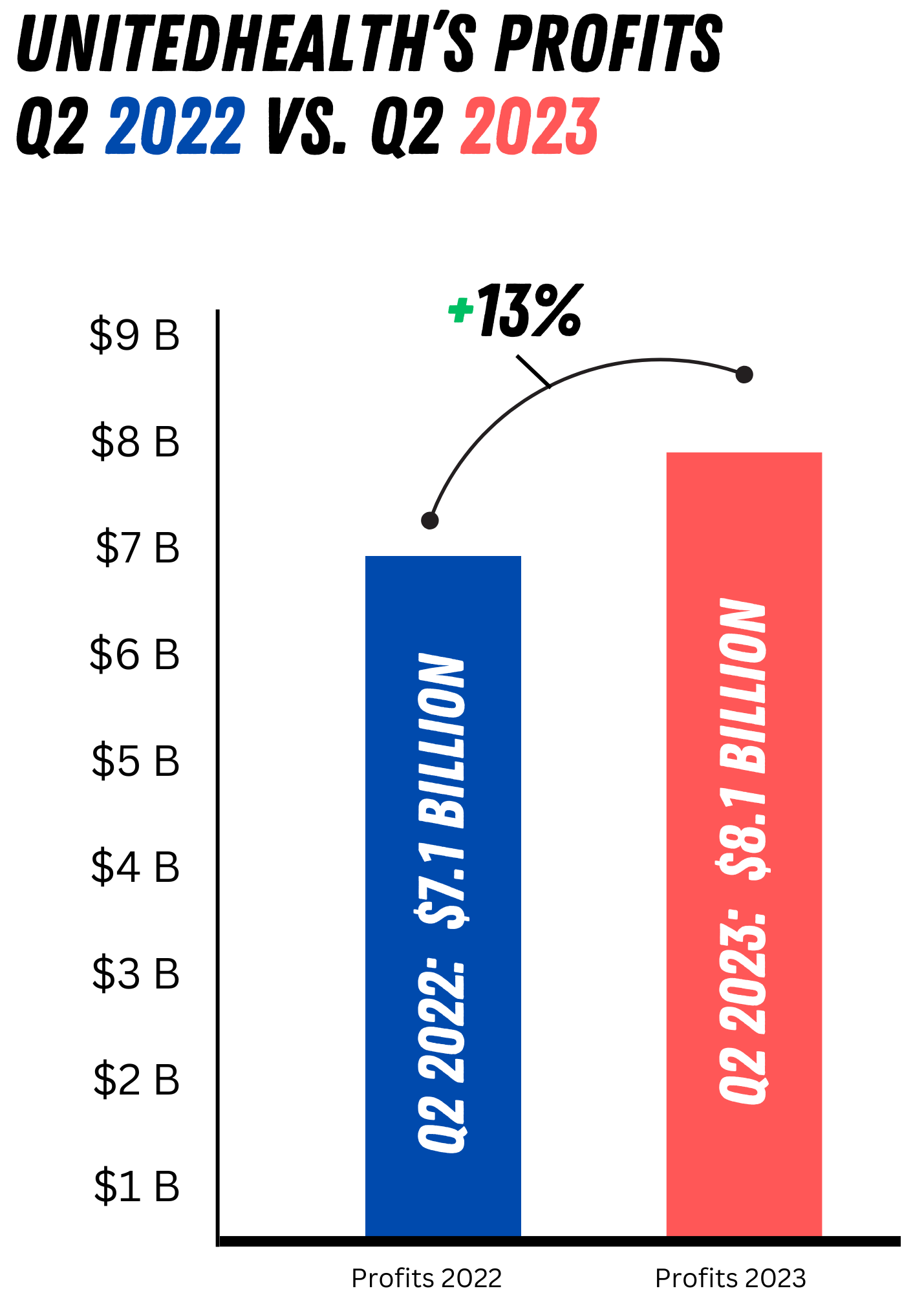

The increase in the company’s profits from operations for the quarter was almost as impressive, soaring 13% from $7.1 billion to $8.1 billion.

Just last month, UnitedHealth’s share price took a hit after an executive said at an investor conference that the company anticipated a “meaningful jump” in outpatient surgeries “that looked like pent-up demand (from the pandemic) being satisfied,” as the AP reported.

But on Friday, investors rushed to buy shares of the company’s stock. By the end of the day, the share price had shot up $32.42–a whopping 7.2%--to $480.17 a share. It was one of the biggest gainers on Wall Street on a day when the Dow was up just 0.33% and both the S&P 500 and Nasdaq were in the red.

Although the company did report a small spike in claims paid during the quarter, it benefited from big gains in enrollment in the company’s Medicare Advantage plans and the Medicaid programs it manages for several states. As has been the case for several quarters, UnitedHealth saw enrollment in its government health plans grow much faster than in its commercial plans.

While enrollment in the company’s employer-sponsored and individual businesses grew by a little more than 2%, enrollment in its highly profitable taxpayer-supported government businesses grew more than twice that rate. The company’s Medicaid enrollment increased by 4.6% to 8.4 million while enrollment in its Medicare Advantage plans grew twice as fast as even that, to 7.6 million, a 9.3% increase.

But it was the Optum division, which in addition to the company’s prescription drug middleman encompasses hundreds of physician practices and outpatient facilities UnitedHealth has bought in recent years, that really shined. Optum’s revenues increased by an eye-popping 25% (from $45.1 billion to $56.3 billion). And it is that growth that also enabled the company to avoid an even bigger hike in its overall medical loss ratio (MLR), which is a measure of how much an insurer pays in claims as a percentage of revenue.

The Affordable Care Act of 2010 requires insurers to spend a minimum of 80%-85% of revenue paying for enrollees’ health care. Wall Street financial analysts had expected the MLR to increase to 83.3% from 81.5% in the same period last year. On Friday, the company said the MLR for the second quarter of 2023 came in at 83.2%--and Wall Street rejoiced. While that might seem to be an inconsequential difference and nothing to cheer about, that .1% represents tens if not hundreds of millions of dollars the company avoided paying out.

But here’s the other thing investors know and that members of Congress are just now beginning to realize: UnitedHealth and its biggest peers (Cigna and CVS/Aetna in particular) have figured out how to circumvent Congressional intent when they included the MLR restrictions in the ACA.

Since the ACA was passed, big insurers have been getting more and more into the delivery of health care goods and services. When I was in the industry, most of the insurers’ acquisitions were of smaller health insurance competitors. That’s what is known as horizontal integration. The companies’ recent growth has come through vertical integration, i.e., buying PBMs, physician practices, and a broad range of outpatient facilities.

This enables the companies to essentially pay themselves by steering their health plan enrollees to their own health care delivery operations.

As CNBC reported:

The company reported total revenue of $92.9 billion for the quarter, up 16% from the same period a year ago. That excludes $33.6 billion in “eliminations,” which are payments from the company’s UnitedHealthcare business to its other division, Optum. UnitedHealth Group can’t record those transactions as revenue because it is paying itself.

The AP’s Tom Murphy put it this way:

The company also said it squeezed more revenue out of customers served through its Optum Health business, which runs clinics, outpatient surgery centers and provides home care. That business has been treating more people through value-based care arrangements, which base care provider pay more on how a patient population does instead of delivering a fee for each service.

I’ll explain how that all works in the coming weeks and help you understand just how huge Optum has become in just a few years and how all of us are affected, regardless of whether we are enrolled in a UnitedHealthcare plan. So stay tuned.

A final note for now: UnitedHealth is always the first of the big insurers to report quarterly earnings and is considered a bellwether for the industry. Sure enough, all the other six big for-profit insurers saw their share price increase on UnitedHealth’s news Friday. The increases ranged from 0.22% for CVS/Aetna to 4.7% and 5.05% for Cigna and Elevance, respectively. Bottom line: those companies’ investors saw a huge return on their investments and will be looking closely to see if UnitedHealth’s competitors follow suit.

Matt Stoller had a great article on the ACA and vertical integration. I'd be interested to see what you can add, since the topic is pretty complex.

OPT. uses hardball tactics to deny paying FSA claims.