UnitedHealth Group, the largest U.S. health insurer, is once again under federal scrutiny—this time for potentially fraudulent Medicare billing practices. As The Wall Street Journal reported, the Department of Justice (DOJ) has launched a civil fraud investigation into the company’s use of diagnoses that trigger higher Medicare Advantage payments. This is just the latest chapter in a long-running saga of how private insurers have exploited the Medicare Advantage system to inflate their profits—at a massive cost to taxpayers.

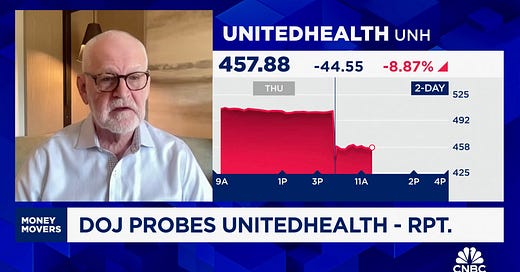

Here is what I said this morning on CNBC about the DOJ’s probe into UnitedHealth:

I think what we’re seeing here is that the Trump administration has really good evidence that a lot of taxpayer dollars can be saved by cracking down on the practices of the insurance industry — on companies like UnitedHealth Group that own and operate Medicare Advantage plans.

[Medicare Advantage] has been a huge cash cow for these companies for several years.

The Medicare Advantage program was sold to the public as a way to save money by allowing private insurers to manage Medicare benefits more efficiently. Instead, it has turned into a $140 billion overpayment bonanza for insurers. The system incentivizes companies like UnitedHealth to game the billing process, ensuring they get paid more by documenting additional—and often questionable—diagnoses for their enrollees.

The Journal’s reporting revealed that UnitedHealth employed aggressive tactics to boost these lucrative diagnoses. Doctors working for the company said they were trained to document revenue-generating conditions, even if they weren’t directly treating them. The insurer also used software to suggest additional medical conditions and even offered financial incentives to clinicians for coding more diagnoses. One former UnitedHealth nurse practitioner told the DOJ that she was pressured to add certain conditions—such as a rare hormonal disorder—to patients' records without proper testing.

The financial consequences of these tactics are staggering. The Journal found that in 2021 alone, UnitedHealth secured an extra $8.7 billion in federal payments based on diagnoses that were never actually treated. One of the key drivers of this overbilling was the company’s in-home assessment program, where nurses—rather than doctors—documented conditions that boosted UnitedHealth’s reimbursements. These visits resulted in an average of $2,735 in additional government payments per patient.

This DOJ probe is just one of many investigations into Medicare Advantage fraud. Over the years, whistleblowers and regulators have repeatedly exposed how insurers manipulate the system, but little has changed. Even as lawsuits and government reports pile up, the industry continues to report in massive profits. And UnitedHealth isn’t alone—other major insurers, including Humana and Cigna, have also faced accusations of inflating Medicare bills.

What’s most infuriating is that, while insurers claim Medicare Advantage provides better care, the evidence says otherwise. Many enrollees struggle with prior authorization barriers and denied care—enabling insurers to pad their bottom lines. Meanwhile, traditional Medicare, which operates without these profit-driven distortions, consistently outperforms Medicare Advantage in several measures of patient satisfaction and access to care.

Today’s news drove UnitedHealth’s stock price down 7.30% in trading on the New York Stock Exchange. The company has been disappointing Wall Street a lot lately, primarily because investors have been concerned that, in their opinion, the company has been paying too many claims. UnitedHealth’s shares have lost a fourth of their value since reaching a 52-week high on November 11. You can be sure that if Congress and the Trump administration crack down on industry practices that enable insurers to overbill the government, investors will once again head for the exits.

Great column. DOJ should investigate and and penalize United healthcare for their corrupt up coding of patient’s diagnoses who receive Medicare Advantage.

Eliminate Medicare advantage, and have everyone eligible be on traditional Medicare. We could improve the care for traditional Medicare and decrease the costs by utilizing Medicare funds and eliminating the corruption and cheating of Medicare advantage by for

profit insurance companies who are more interested in their shareholders than in their patients.

United has paid many times over the years for different violations. Unless there is the will to stand up to the business itself, these fines are no genuine disincentive when you make billions in profit each quarter. Cases like this take years and in the meantime, UHC runs amok.

https://violationtracker.goodjobsfirst.org/?company=United+Healthcare&order=pen_year&sort=