The Press Is Beginning to Take Notice of How Health Insurers Are Raiding The Medicare Trust Fund

Sometimes a health policy story comes along that should be shouted from the rafters — well at least reported by media that cover the subject. Brett Arends’ story for Dow Jones’ MarketWatch is one of those stories.

In “Medicare Advantage is overbilling Medicare by 22%,” Arends introduces readers to a government agency that in its latest report exposed Medicare Advantage plans to light. The revelations about overpayments come from the Medicare Payment Advisory Commission, MedPAC for short, some of whose recommendations over the years have resulted in high rate increases for Advantage plan sellers that helped make it possible for them to offer groceries, bits of dental care, and other goodies seniors have snapped up. The media’s role in revealing and dissecting those overpayments is long overdue.

The last several months news outlets have been paying more attention to the downsides of Medicare Advantage plans. Arends’ story focused on one thread in the story: MedPAC’s latest report to Congress that revealed something health policy wonks — but not the public — have known for a long time. Medicare Advantage plans are taking advantage of the federal gravy train.

“The private insurers who now run more than half of all Medicare plans are overcharging the taxpayers by a staggering $83 billion a year,” Arends wrote. “They are charging us taxpayers 22% more than it would cost us to provide the same health insurance to seniors directly if we just cut out the private insurance companies as middlemen.”

MedPAC was set up by the Balanced Budget Act of 1997, “back when people in Washington were actually doing their jobs,” Arends points out. The commission’s job is to advise Congress on issues involving Medicare. MedPAC reports discuss the financial situation of the Medicare trust funds, and over the years those reports often revealed that the private health plans have been overpaid. Until recently, there has been little to no pushback from the government or most of the media, in effect leaving the insurance industry a clear path to sell Medicare Advantage plans to more than half of the Medicare market. The media have recently begun to ask why.

Arends calls the Medicare Advantage arrangement “a rip-off, pure and simple,” noting that what sellers of the plan are paid “is more than twice as much as it would cost simply to provide free dental, hearing and vision care to all traditional Medicare beneficiaries, not just those in private ‘Medicare Advantage’ plans.”

I have covered Medicare for decades now and have often asked the experts why there couldn’t be a level playing field that would allow beneficiaries in the traditional program to receive vision and dental benefits. The answer was always, “We can’t afford that.”

Arends debunks that thinking by directly quoting the MedPAC report:

“It reads: ‘We estimate that Medicare spends approximately 22 percent more for MA enrollees than it would spend if those beneficiaries were enrolled in FFS (fee for service or traditional) Medicare, a difference that translates into a projected $83 billion in 2024.’ MedPAC reported that its review of private plan payments suggests that over the 39-year history with private plans, they “have never yielded aggregate savings for the Medicare program. Throughout the history of Medicare managed care, the program (Medicare Advantage) has paid more than it would have paid if beneficiaries had been in FFS (fee for service) Medicare.”

I checked in with Fred Schulte, who now writes for KFF Health News, and who over his career has written many prize-winning stories documenting the shenanigans insurers have used to enhance their reimbursements from Medicare, such as upcoding. That’s the practice of billing Medicare for ailments that are more serious than what patients actually have. “For example, instead of reporting a patient has diabetes, the insurers would say diabetes with neuropathy or eye problems and receive higher reimbursement,” he explained.

“It took a very long time for the government and the Justice Department to understand what was going on here with this coding,” Schulte said. “The codes just kept getting higher and higher, and profits kept going up and up.”

A year ago, Paul Ginsburg, a senior fellow at the University of Southern California’s Schaffer Center, said, “The current Medicare Advantage structure results in overpayments, markedly higher than previously understood.”

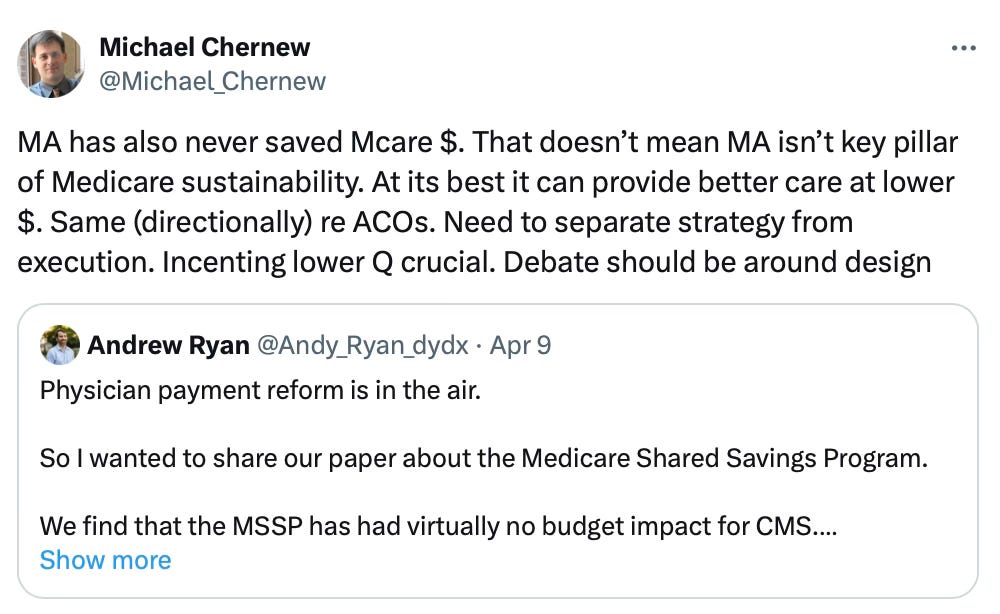

Even Michael Chernow, who heads the Medicare Payment Advisory Commission authorized by Congress in 1997, recently admitted on Twitter that Medicare Advantage “has never saved Medicare money.” But he added, “that doesn’t mean Medicare Advantage isn’t a key pillar of Medicare sustainability. At its best it can provide better care at lower cost.”

Arends’ story doesn’t sound hopeful about the direction of Medicare. He concludes, “Medicare Advantage isn’t making the rest of Medicare better. It is putting the rest of Medicare out of business. And not by being more efficient, but by being less efficient. It is driving up the overall cost of Medicare by 22%. And not by being more efficient but by being less efficient. The logical outcome is that traditional Medicare ceases to exist and that Medicare dollars pass through the hands of private insurance companies at 122 cents on the dollar.”

Arends’ prediction may well come true, but perhaps not without a fight. David Lipschutz, associate director at the Center for Medicare Advocacy, says a “confluence of factors have come together to make it harder to ignore the problems of Medicare Advantage by the press and policymakers.”

Incredibly important article - I just discussed it with my father and sent it to Wendell a few weeks ago. As a patient advocate and a medical writer with physicians as clients, I am hopeful Arends' article is just the beginning.

I will do everything I can to shout this from the mountaintops - super important and glad to hear that Brett's story is getting attention. Boiling it down to the fact that our tax dollars are subsidizing profits for commercial insurers SICKENS me. How bout this idea - get rid of MA, and take the money that HAD been going to commercial insurers (use 10% of the 22% they've been overpaying) and use it to cover the large deductibles (which is why people get MA plans to begin with!). Congress needs to wake the hell up!