The Dirty Trick Health Insurers Are Playing That You Don’t Know About

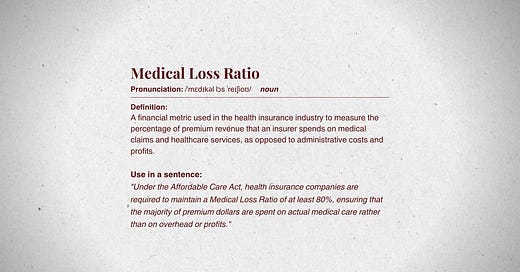

The medical loss ratio (MLR) limits how much of your premium dollars insurers can use to pad their profits and for “overhead.” The thing is: They’ve have found a way around it.

When it comes to health insurance, there’s a sneaky little metric known as the medical loss ratio (MLR). Never heard of it? Most members of Congress hadn’t either until I talked about it when I testified before a Senate committee back in the day. A few months after I testified, President Obama signed the Affordable Care Act (ACA) into law, and it contains a provision that deals with the MLR.

Now, before your eyes glaze over and you start thinking about literally anything else, let’s break it down in simple terms: The MLR tells you how much of your premium dollar your insurance company uses to pay for your medical care.

Before the ACA, insurers were spending less and less of your premiums every year paying your claims. In some cases, they were spending 50% or less and using most of the rest to trick out their fancy buildings, pay for their corporate jets and reward their top executives and shareholders. They categorized all that as “overhead” and claimed it was necessary to cover administrative expenses.

When members of Congress were debating health care reform back in 2009 and 2010, they had the wild idea that insurers should spend at least 80-85% of the premiums they collect on real health care costs, leaving only 15-20% for their "overhead." The goal? To stop insurers from charging you an arm and a leg just to pad their bottom lines and make Wall Street investors happy.

The intent was to keep insurance companies more honest by not allowing them to spend more than a reasonable amount of what you send them every month on all that “overhead” and use most of it on actual health care — doctors, hospitals, treatments, you know, the stuff you’re paying for, or at least think you’re paying for. But as I’ve often said, the one thing insurance companies know best is how to make money – and how to find loopholes and workarounds to any law that gets passed. And they have done exactly that since the MLR provision went into effect 10 years ago.

Big insurance companies circumventing the MLR is THE dirty trick being played by these companies (which is saying a lot because they play a lot of dirty tricks on us all the time). In many ways, pinpointing what MLR manipulation is and how big health insurers use it to boost profits is like naming the demon — and can give power to policymakers and the public to push back.

Sounds fair, right? But here’s where it gets interesting. Big health insurance companies, with their army of lawyers and accountants, have turned avoiding the spirit of the MLR into an art form. Big insurers are not content with just that 15-20% slice of the pie — they want the whole bakery.

They’ve figured out clever ways to shuffle costs around, reclassify expenses, and game the system, so they can still rake in massive profits while technically staying within the MLR limits and Congressional intent. It’s like a magician’s trick: “Look over here at our compliance!” — meanwhile, they’re slipping your money into their back pockets.

One popular trick is manipulating the definition of “quality improvement” activities. These are supposed to be initiatives that genuinely improve patient care and keep us from getting sick in the first place. But insurers often stretch the definition of “quality improvement.” Suddenly, things like fancy software upgrades or marketing campaigns to lure in more customers (sorry, “educate” patients) get counted as quality improvement, reducing the apparent profits and making it seem like they’re spending more on health care than they really are.

As if that wasn’t bad enough, crafty insurers have figured out yet another way to keep more of your money than Congress intended. They have bought hundreds of physician practices and clinics and steer their health plan “members” to the docs they employ and facilities they own. That’s because the ACA’s MLR provision doesn’t apply to health care delivery, just health insurance. You might recall that HEALTHCARE un-covered explained that workaround a few months back.

Why should you care about this financial wizardry? Because it directly affects your wallet and your health. When big health insurers like UnitedHealth, Cigna and CVS/Aetna manipulate the MLR, they’re skirting the rules meant to protect you, the consumer. Instead of lowering premiums or enhancing your coverage, they’re pocketing extra cash.

In a fair world – and the world Congress intended – if insurers spent less on your care, you’d get some money back or pay lower premiums. But in this world, they keep finding ways to keep those extra dollars while you’re left wondering why your premiums keep rising even though you barely go to the doctor.

So, the next time you hear about the MLR, don’t just think of it as another confusing acronym. Think of it as a financial watchdog that’s supposed to be guarding your hard-earned money from greedy insurers and their investors — only, this watchdog has been muzzled. And while Congress may have had the best of intentions, it’s clear that insurance companies are still finding ways to come out on top, leaving Americans to foot the bill for a game they didn’t even know they were playing.

When is the US Congress and Senate going to outlaw these despicable abuses of patient and taxpayers’ money? When are we going to see genuine action from the Legislative Branch. I wonder people do not trust the Government or mistakenly think that an authoritarian regime will expose the corrupt politicians and punish them appropriately. None of that is going to happen. Privatized and allegedly competitive capitalism has been and continues to be a complete and utter failure. How long are people going to continue denying the truth about these greedy insurance giants??? When are we going to practice what we pontificate so loudly?

People with "Obamacare" are merely "plumbing parts" for the greed of these corporate raiders. Money flows through the pipes, from the "well" of the federal government (via monthly premiums/subsidies) to Health Insurance Companies, and the bulk of that flow never reaches or touches the consumer/patient. The patient gets just a small amount of that "water," when-and-where the plumbers have thus-far not fixed those little "leaks" in their own favor, via manipulations like the ones described in this article. People are dying from this "dehydration."