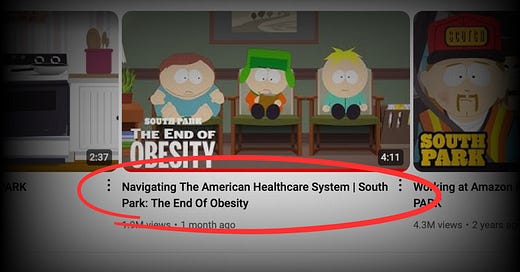

I’m writing today to praise the boys of South Park for helping us understand how futile it has become to get a health insurance company to do the right thing.

In a typically brilliant and irreverent South Park episode, we follow Kyle as he sets out on a mission to get an obscenely profitable insurer to pay for his friend Cartman’s weight-loss meds. Without giving too much away, Kyle and Cartman realize they’re on a fool’s errand as they try, naively but with determination, to “navigate” the byzantine U.S. health care “system.”

They discover what millions of human Americans learn every year when they need care and believe, as naively as Kyle and Cartman, that the insurance card in their wallets is worth the fortune they pay for it. The endless barriers greedy execs have put in place are there for a reason – to enable them to stuff their pocket by picking ours. My favorite scene is near the end. We see the ultimate man in charge, I’m guessing the CEO but it could be the insurer’s medical director, sunning himself on a yacht and delivering the final answer: “No.” You’re not going to get those meds, Cartman, so just go ahead and embrace Lizzo.

You won’t hear “prior authorization” mentioned in the segment, probably because zero fans of South Park have ever encountered the term. When was the last time you heard insurance company shills Joe Namath and JJ Walker mention prior authorization in one of those insidious TV ads designed to lure Kyle and Cartman’s grandmas into a privatized version of Medicare? Like never, right?

Insurance companies hide that ball because they don’t want you to know anything about it until you actually need to use that card in your wallet. If you have any kind of insurance policy in America, with the notable exception of original, non-privatized Medicare, at some point in your life you’re going to run up against prior authorization. Insurance companies want you to believe they’ve put that often deadly barrier to care in place to keep your doctor from overtreating you, but, as a former industry propagandist with years of experience in the art of deception, I can assure you it is there to help them meet Wall Street’s profit expectations.

Your doctor certainly knows about prior authorization. Physicians have been complaining mightily about it to lawmakers for several years, and a few states and the Centers for Medicare and Medicaid Services have taken steps to limit its use. Nevertheless, insurers maintain a very long list of treatments and medications they insist need clearance from them before they’ll pay a dime.

Insurers’ prior authorization demands are a big contributor to physician burnout and why, to a large extent, health care is so expensive in this country. It adds billions to administrative expenses we pay for with our premiums and taxes. Every physician practice, every clinic and every hospital in the United States has to have people on staff, often hundreds of people, who do nothing more, day in and day out, than call and fax – yes, fax – insurance companies in the hope of ultimately getting to a “yes” for their patients.

It can be such an exhausting and often fruitless battle that millions of sick Americans just give up and suffer in pain–and in many cases die prematurely. The American Medical Association published a report just last week titled, “Exhausted by prior auth, many patients abandon care.” The AMA said that more than nine in 10 doctors it surveyed said prior authorization has a negative impact on patient clinical outcomes. “Most telling,” the AMA noted, “is that 78% of physicians reported that prior authorization often or sometimes results in their patients abandoning a recommended course of treatment.”

And even if an insurance company eventually comes around to approving your treatment or meds, that’s no assurance it will actually pay for it, as I learned during my 20 years in the insurance game. Under the headline, “In Denial: Insurance companies are in the business of saying ‘no,” New York Magazine last week quoted me as saying that insurers “know that a percentage of people simply will not appeal, often because people don’t think it’s worth the time and effort or just because it is a chore.” Prior authorization and refusing to pay legitimate claims after care has been delivered are big contributors to the astonishing profits big insurance companies are making these days. As I noted a few days ago, UnitedHealth alone made nearly $16 billion in profits in just the first six months of this year.

Speaking of UnitedHealthcare, that company reportedly is the worst in denying claims. According to ValuePenguin, UnitedHealthcare denies about one-third of in-network claims submitted. That’s twice the industry average, which is saying something.

Knowing that relatively few folks subscribe to New York Magazine or read AMA reports, I want to express my gratitude to the South Park kids for explaining in just a few hilarious minutes how prior auth works and what it means. Do yourself a favor today and watch it.

And if you have a few more minutes to dive deeper into prior auth, watch this not-so-funny New York Times video explainer. Then call your congressman and raise holy hell as if your life depended on it. Because it does.

That South Park video is more documentary than satire. As a doctor in network with some of the United Healthcare plans, they are a nightmare. They won't even give us a full list of which procedures they require pre-auth for. Since we don't know what needs pre-auth and what doesn't, we get pre-auth for everything which just delays care. Ultimately, they give the pre-auth for everything we submit, which leads one to believe it is just a sham requirement done in the hope that people either give up and go without the recommended procedure or people go to an out of network provider and pay out of pocket. Either way, it is a win for the insurance company that does not give a damn about the live human being that literally pays them for nothing.

I'm in prior auth hell right now. I have one drug--that may enable me to walk again--being denied because the prescription is for a non-FDA approved use of the medication. The insurance company just called me to give me the contact information for the manufacturer's discount program--which feels like a slap in the face: "We won't cover this medication, despite that being out jobs, but the people who make it might." The manufacturer's program requires you to be using the medication for an FDA-approved reason. And around and around the carousel of broken dreams and calamitous nightmares goes...