Andrew Witty, CEO of the health care giant UnitedHealth Group, likely will be facing the most challenging rooms of his career when he appears on Capitol Hill today, starting with the Senate Finance Committee at 9 a.m. and then the House Energy & Commerce Subcommittee on Oversight and Investigations at 2 p.m. He’ll be on the hot seat as lawmakers press him for answers about how a UnitedHealth subsidiary, Change Healthcare, could be hacked so easily and be unable to pay doctors and hospitals for weeks.

What to expect: A considerably more hostile group of questioners than the Wall Street financial analysts who, in typical fashion, lobbed softballs at him during the company’s first quarter 2024 earnings call two weeks ago. At least some of the lawmakers will not be nearly as deferential as those analysts were.

What to be on the lookout for: Which members of Congress will show up loaded for bear and which ones will be parroting the company’s talking points in appreciation for the millions of dollars in campaign contributions UnitedHealth doles out every year.

Witty likely used that April 16 call with analysts to try out some of those talking points. First, I suspect he’ll try to downplay the vast size and reach of UnitedHealth. He told analysts his company is “a comparatively small part of the $5 trillion U.S. health system.”

The truth: It is anything but small. Only four American companies–Walmart, Amazon, Exxon Mobil and Apple–take in more revenue. It has grown by leaps and bounds since a UnitedHealth CEO last testified before Congress. Back then, in 2009 when Congress was debating what would become the Affordable Care Act, the company’s revenues totaled $87.1 billion. Last year, they soared to $371.6 billion.

Much of that explosive growth has been fueled by our tax dollars, thanks to inattentive or bought off lawmakers and regulators and friendly courts that have green lit a steady stream of acquisitions that comprise UnitedHealth’s Optum division, which encompasses Change Healthcare and the huge pharmacy benefit manager Optum Rx. In 2009, Optum took in $21.8 billion in revenues. Last year: $226.6 billion.

Second, I bet he’ll try to convince committee members it’s a damn good thing a Trump-appointed federal judge approved UnitedHealth’s purchase of Change in 2022, despite the Department of Justice’s attempts to block it. Witty told Wall Street:

“Fortunately, we were able to bring to bear the substantial resources of UnitedHealth Group to drive the recovery and begin to mitigate the impact. Resources…Change Healthcare would not have had access to on its own.”

My take: The hackers probably wouldn’t have found Change such a rich ransom target if not for UnitedHealth’s deep pockets.

Third: It’s a good thing for America that UnitedHealth keeps buying up the health care delivery system and has the financial resources to rescue physician practices and clinics in financial distress. He told analysts that, “As I think you see some of the funding changes play out across the — across the next few years, I suspect that may also create new opportunities for us as different companies assess their positions.”

Translation (although don’t expect him to say these exact words): UnitedHealth’s burdensome business practices and the way it shortchanges doctors (those “funding changes” he referenced) contribute to the financial distress that is forcing many health care providers to “assess their positions.”

To get you up to speed on UnitedHealth and what’s at stake today, below are links to some of the stories we’ve published over the past several months to help you–and the folks you vote for, including those he’ll face today–understand how this single company, in such a short period of time, has become the dominant player in an accelerating corporate takeover of our health care system, a takeover that is transferring so much wealth from taxpayers to rich shareholders–including Mr. Witty himself.

UnitedHealth Group, the Biggest Private Health Insurer on the Planet, Made $8.5 Billion in Profits in Q1 2024

Wendell Potter | April 16, 2024

How We Voted in 2016 Contributed to UnitedHealth's Acquisition of Change Healthcare

Wendell Potter | April 09, 2024

New reports detail UnitedHealth's latest acquisitions under shady pretenses

Wendell Potter | March 11, 2024

UnitedHealth Group: vulnerable and ill-equipped to defend against modern threats like cyberattacks

Wendell Potter | March 5, 2024

UnitedHealth Group takes Wall Street hit because of investors' fears about Medicare Advantage profitability, Department of Justice antitrust investigation

Wendell Potter | February 28, 2024

UnitedHealth’s self-dealing is accelerating

Sara Sirota and Krista Brown | January 12, 2024

Mapping UnitedHealth’s consumption of our health care system – from the ‘70s to today

Sara Sirota and Krista Brown | December 20, 2023

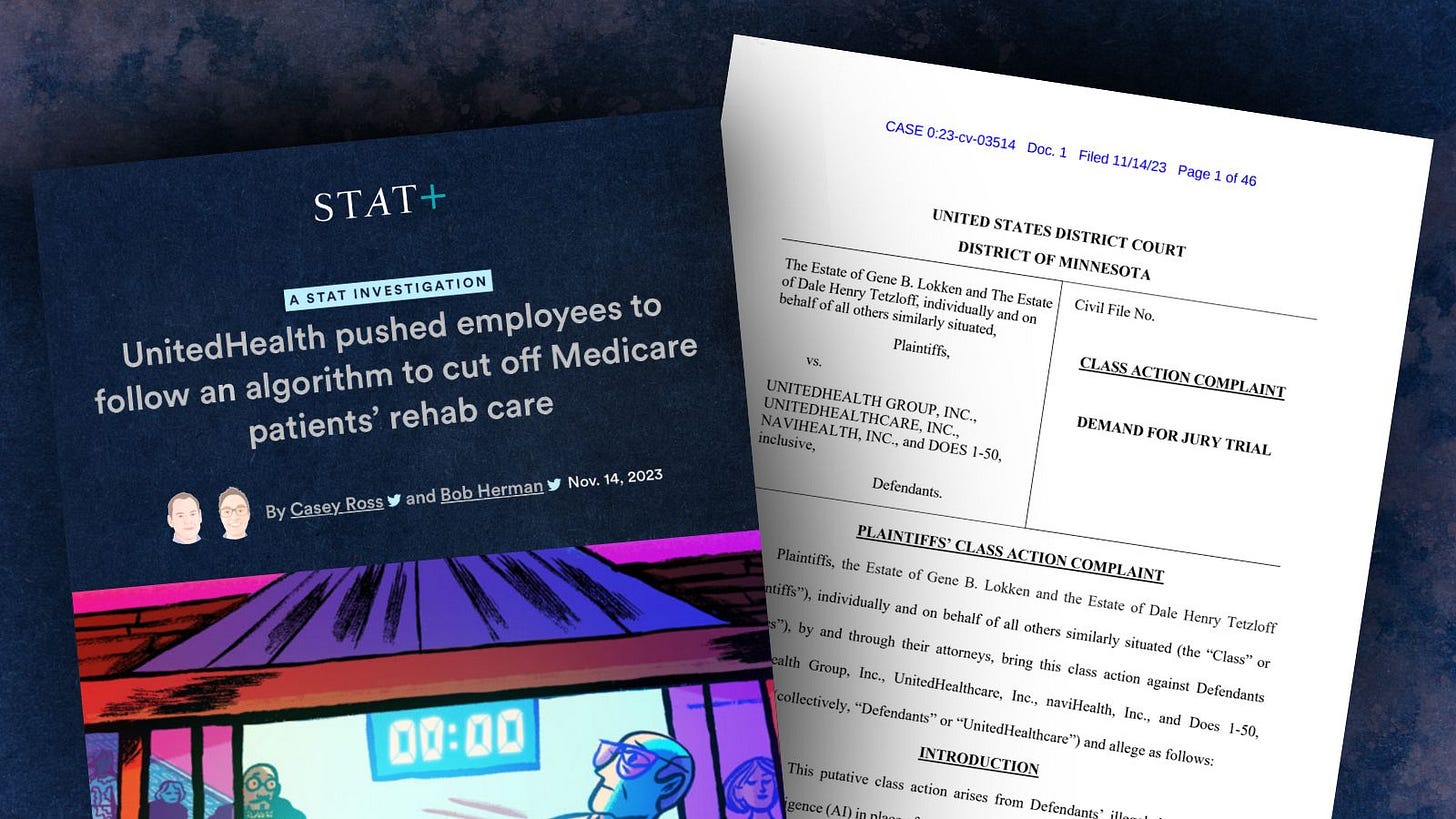

Reports and lawsuits allege UnitedHealth uses AI algorithms to cut off care for the elderly and disabled

Wendell Potter | November 15, 2023

How UnitedHealth became Goliath, Medusa and mythical sirens all wrapped into one

Wendell Potter | October 5, 2023

Finally, Big Insurance's Pharmacy Benefit Managers are being probed by Congress

Wendell Potter | May 15, 2023

At issue is the Hill does nothing as a follow-up. The do nothing to insurance, pharma, or PBMs. And as long as Citizen’s United exists, nothing will change.