Haunted Health: Beware the Ghost Networks This Halloween (And All Year Long)

It’s not just any ghost – it’s the kind that promises mental health care, only to vanish the moment you need it.

This Halloween, as you prepare for haunted houses and spooky stories, let me tell you about a specter that doesn’t just lurk on October 31 – but instead every day of the year for far too many Americans. I’m talking about the ghost network lurking inside your health insurance plan.

Many health insurance provider directories — whether public or private — are filled with outdated or inaccurate information, giving you the illusion that help is just a phone call away. But when you finally reach out, it very well could be a doctor or therapist who has retired, moved away or simply isn’t taking new patients anymore. It’s a cruel trick, and for millions of Americans struggling with mental health issues, there’s no treat in sight.

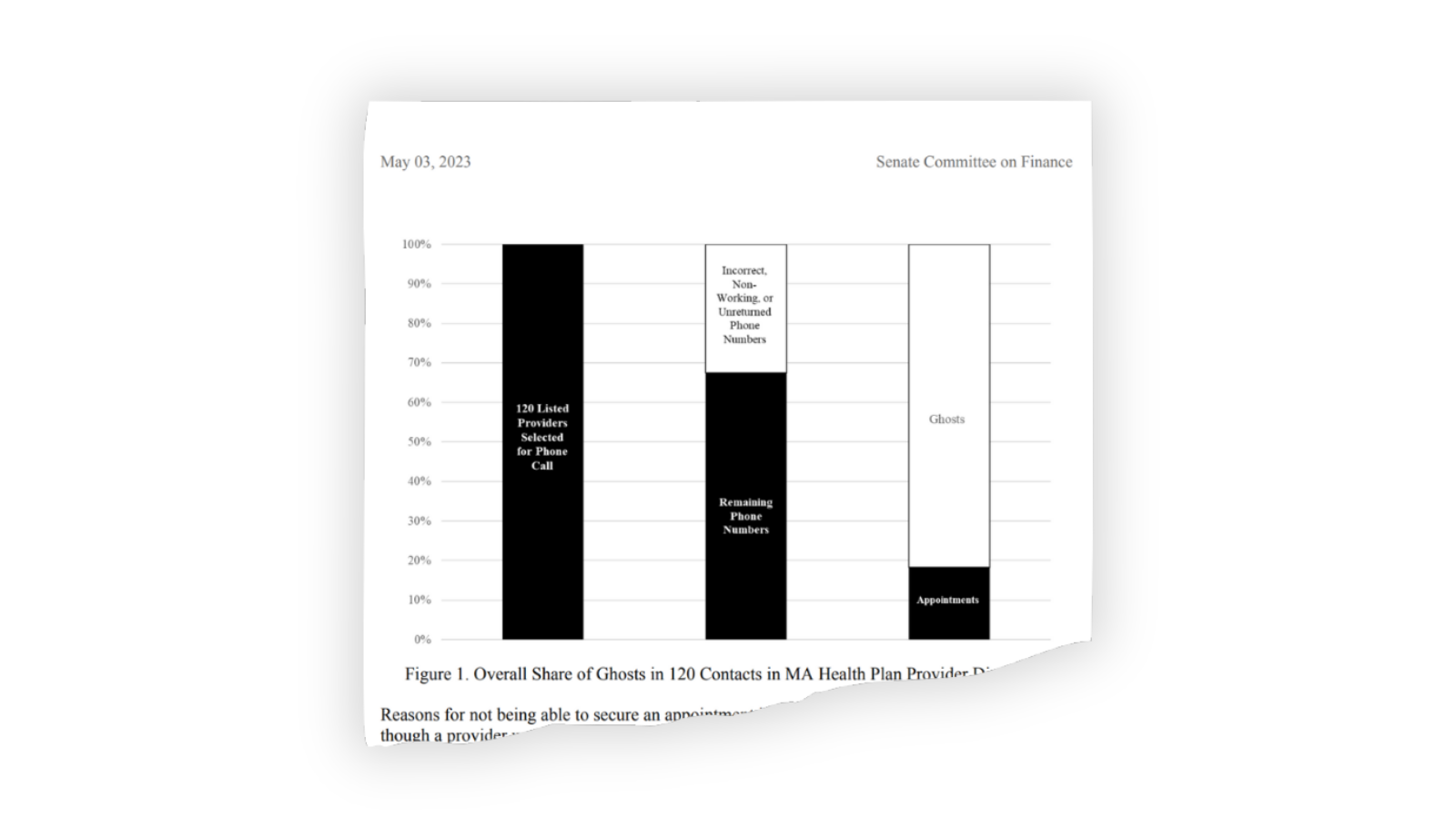

Directories claim to offer a wide range of in-network mental health professionals, but in reality, many of these providers are unreachable. A Senate Finance Committee study revealed that of 120 mental health provider listings across 12 Medicare Advantage plans, only 18% of the listed providers were available for appointments.

Even worse, a similar study by the Seattle Times found that only 8% – yes, 8% – of the 400 mental health providers listed by Washington state’s largest insurers offered appointments. If this sounds like a horror movie, that’s because it is — except this is no movie, and the real-life consequences are devastating.

Why do these ghost networks exist? The simple answer: profits.

Health insurers benefit from creating the illusion of a robust, in-network mental health provider base while avoiding the costs associated with actually providing access to care and paying for it. When people can’t find an in-network provider, many either give up on seeking care entirely or go out-of-network, often facing significantly higher costs. Either way, insurers save money by paying fewer claims. The deliberate creation of ghost networks ensures that patients, already grappling with mental health challenges, are more likely to get lost in this haunted maze of false promises while insurers cash in their premiums.

The consequences of these ghost networks are staggering. According to Harvard Law’s Bill of Health, more than half of adults experiencing a mental illness in the U.S. — more than 28 million people — go without treatment. Ghost networks only deepen this crisis by adding unnecessary barriers to care. Patients are left with few options: They either wait endlessly for an in-network appointment that may never come, or they go out of network and bear the brunt of higher costs, which can be financially crippling. Many people simply give up, unable to afford the care they need, further exacerbating mental health issues.

So, what can be done to exorcise these ghost networks from our health care system?

Some lawmakers are starting to act. The federal No Surprises Act, passed in 2021, mandates that health insurers update their provider directories at least every 90 days. While this is a step in the right direction, compliance has been weak due to a lack of enforcement and inadequate staffing on the part of insurers. Additionally, the Consolidated Appropriations Act of 2023 requires Medicaid plans to maintain accurate and searchable provider directories, but enforcement remains limited. And neither law allows patients to take insurers to court if they fail to maintain accurate directories.

More promising legislation could be on the horizon, however. The Behavioral Health Network and Directory Improvement Act, sponsored by Sens. Tina Smith (D-Minnesota) and Ron Wyden (D-Oregon) would enforce stricter directory adequacy standards, require insurers and the federal government to conduct audits on the accuracy of provider networks, and publicly share their findings.

States also have a critical role to play, and many already have network adequacy standards that require insurers to maintain a certain number of in-network mental health providers who are geographically accessible.

Ultimately, insurers need to do more than just comply with regulations; they need to tackle the root causes of ghost networks. Notoriously low reimbursement rates for mental health providers are one of the biggest factors contributing to the scarcity of in-network professionals. Many mental health providers can earn two to three times more by charging patients out-of-pocket than they would by accepting Medicare or Medicaid. By increasing reimbursement rates, insurers could incentivize more mental health providers to join their networks, which would make ghost entries less common and increase access to care.

So this Halloween, as you carve pumpkins and don your costumes, remember that the real terror may not come from the ghosts hanging on your porch, but from the ghost networks hidden in your insurance plan. These networks are the ultimate trick, making it hard to treat your mental health care.

I had to deal with these ghost mental health networks for my daughter. Many of the providers ended up to be physicians assistants at what I call pill mills. She never saw the same provider twice and never received any counseling.

When I finally found her a real psychiatrist, I had to pay our of pocket for her appointments.

Yes, these insurance companies must be required to be transparent about their doctors and their promised care.

Ever asked yourself, "Just how awful could the lack of oversight and monitoring for these provider network databases really be?"

In a word, ABYSMAL...

Among the results returned for my recent DME provider search were several obsolete entities, multiple providers who told me they didn't handle the supplies I needed (can't filter search by services), and THEN there was the record for an unnamed provider with 2 locations; both of which were MY PRIVATE, RESIDENTIAL ADDRESSES, where I had received deliveries of DME supplies! It took me over a month to get my addresses removed from the PUBLICLY ACCESSIBLE provider search tool.

That's quality assurance for you.