Elevance and other for-profit insurers find new scrutiny from lawmakers over their denials of care for Medicaid patients

You may recall that we published a piece earlier this month about how Elevance and other big for-profit health insurers are refusing to authorize coverage for much of the care ordered by doctors and hospitals that treat Medicaid patients.

That story was based on a report by federal investigators which found that Elevance, previously known as Anthem and which manages Medicaid programs in 20 states, denied more than one of every three requests for doctor-ordered treatments or medications in at least one of its Medicaid plans. Elevance/Anthem’s 34% denial rate was second only to a Molina plan, also operated on a for-profit basis, that denied 41% of physicians’ coverage requests.

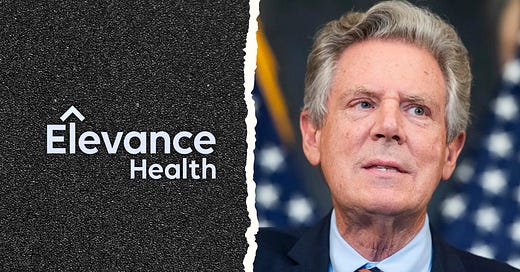

Well, the Washington Post’s Health 202 newsletter is reporting that Rep. Frank Pallone of New Jersey, the highest-ranking Democrat on the House Energy & Commerce Committee, is launching an inquiry into how insurers use “prior authorization,” as described by the Department of Health and Human Services Office of Inspector General, to refuse coverage for care Medicaid patients need.

The OIG found that overall, insurers denied an average of one of every eight requests for treatment of Medicaid patients. Elevance and other for-profits greatly exceeded that average, which is far more than the denial rates in the Medicare Advantage program, which in turn is far higher than denial rates in insurers’ commercial health plans.

Kudos to Pallone for opening this much-needed inquiry. Sen. Ron Wyden of Oregon, who chairs the Senate Finance Committee, should follow Pallone’s lead and launch his own investigation.

It’s worth noting again that Elevance, now the 22nd largest corporation in America, is in the third of a series of protracted contract disputes with three hospitals systems in Ohio that treat many of the state’s Medicaid patients. The one with Bon Secours Mercy Health continues to drag on. On July 1, Elevance booted BSMH out of its provider network, meaning that Medicaid patients receiving care at its hospitals have to scramble to find other hospitals to treat them or face potentially high out-of-pocket costs.

We’ll keep you posted.

First I’m a retired RN with both hospital, rural clinic, and public health experience. I’m quite aware of these practices from personal encounters with patients and having to jump through hoops and pushing some of those Medicaid insurers to get authorization for even the most simple tests in our rural are where healthcare is already inaccessible to many. Honestly, it sometimes came down to getting the “nice” person. I got to know them and started asking specifically for her. It usually worked.

I’m thinking of another issue that has always bothered me. Since implementing the DRG coding system for billing it’s become an art for coders to manipulate the diagnoses that bring the most reimbursement even if they weren’t even seen for that problem. The skilled coder chooses the diagnosis from the patients medical problem list that has the highest reimbursement rate then lists the true diagnosis as the secondary. For instance someone comes in for a simple bladder infection but they also have diabetes. The diabetes has a higher reimbursement than the bladder infection. So a diabetes diagnosis is listed as the primary diagnosis, UTI is secondary. It’s not totally fraudulent because the provider probably asks a few questions about the patients diet and whether they’re taking their meds. But it wasn’t the primary reason for the visit. This is very prevalent in the hospital setting as those reimbursements are often substantial. My mom was hospitalized for a GI issue. She has a history of breast cancer but has been cancer free for years. When we got the bill the primary diagnosis was listed as breast cancer. They were reimbursed over $100,000. I checked what the reimbursement was for the real reason she was admitted. It was at least $40,000 less. She ended up being there almost a month and ultimately died. But the issue was the deceptive billing practices. I imagine private hospitals are more aggressive in their coding practices since private insurance pays much better than those with Medicaid and Medicare.

Maybe a team of medical professionals should routinely make unannounced visits to these facilities and review the medical charts and the discharge diagnosis and compare that to the reimbursement they received for each. You may find quite a few in my opinion.

Ok I’m done. Senator Wyden what are you doing in Ohio? Come visit us in Oregon one of these days! 😉

Most of these articles are focused on patient rights which is highly important but what I don’t see anyone discussing is how these large payer groups are devastating small healthcare practices with completely fraudulent and what should be criminal practices. They make up the rules as they go along & recoup at will. Something has to be done, they are committing fraudulent practices against upstanding practices & business while breaking all of their own “rules”