DEATH PANELS ABROAD: Cigna Whistleblower Reveals How Employees in the Philippines Play a Key Role in Denying Care for American Beneficiaries

Also, Cigna medical directors spend, on average, four minutes to decide on complicated cases.

If you are enrolled in a Cigna health plan–and possibly any other health plan operated by Big Insurance–someone in the Philippines likely plays an important role in whether you will get the treatment or medications your doctor says could save your life.

As unsettling as that is, it gets worse: If that person in the Philippines disagrees with your doctor, he or she will flag it for a Cigna medical director who will spend, on average, four minutes deciding your fate. If that medical director spends more time reviewing your “case,” they could be singled out as an outlier, putting their compensation–and very possibly their job–at risk.

That is not just my opinion or even just based on my own personal experience as a former Cigna executive. It is based on an explosive investigative report published this morning by ProPublica and Capitol Forum.

Here’s what else I know from my two decades in the health insurance business: That medical director who has your life in their hands will also not want to be an outlier when it comes to denying coverage, which, for all practical purposes, is the same as denying the care you need. If a medical director at a big insurance company denies too few “prior authorization” requests and falls out of sync with their peers or the corporation’s metrics-based expectations, they could find themselves at the bottom of the dreaded “forced ranking” list of employees to be fired at the end of the year. That, folks, is at the heart of what insurance company executives are saying to investors and Wall Street financial analysts when they talk in coded language about the “medical management” levers they can pull to boost profits.

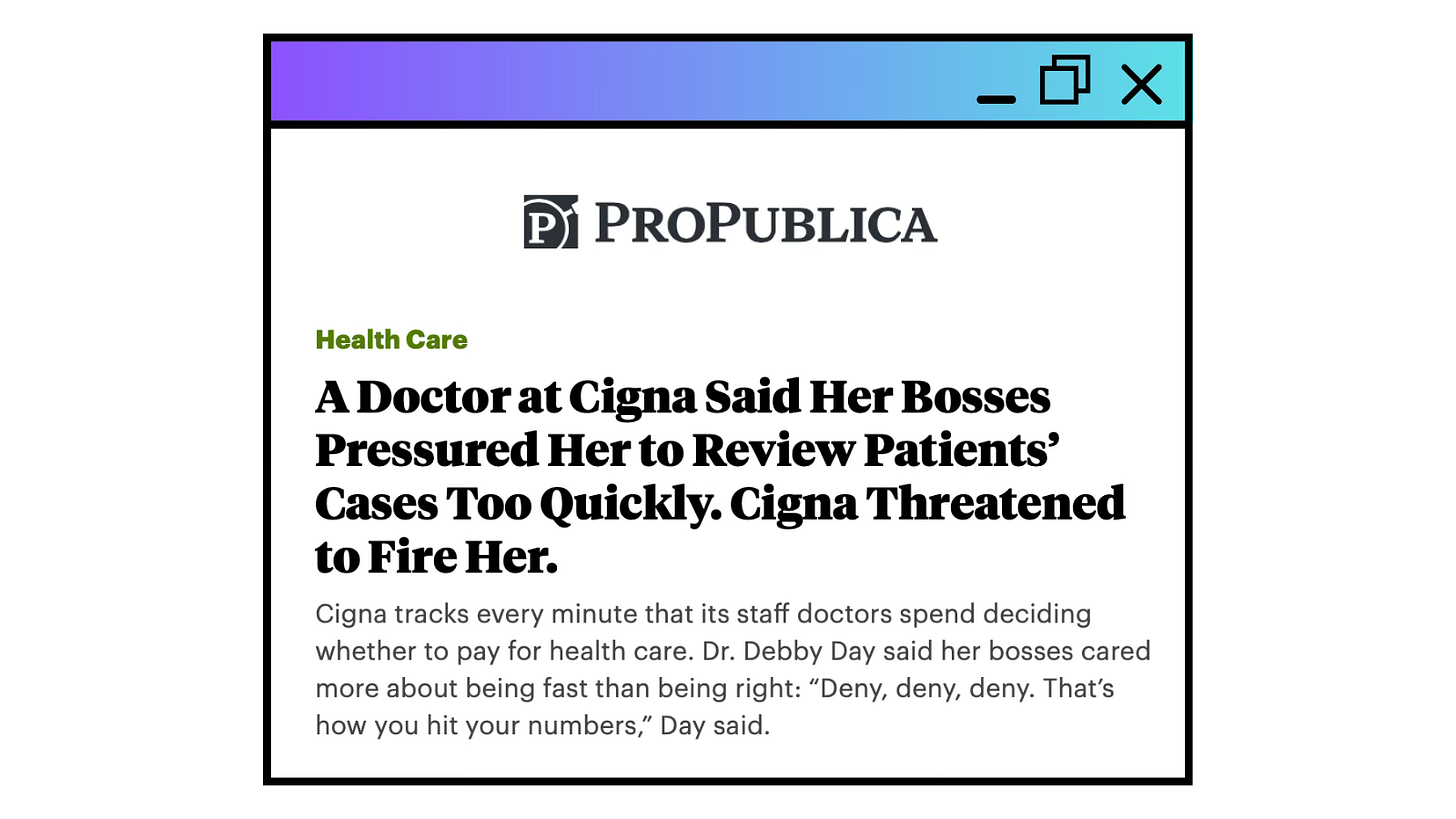

Just the headline of the story sent chills up my spine and my heart racing: A Doctor at Cigna Said Her Bosses Pressured Her to Review Patients’ Cases Too Quickly. Cigna Threatened to Fire Her.

Then came the subhead: Cigna tracks every minute that its staff doctors spend deciding whether to pay for health care. Dr. Debby Day said her bosses cared more about being fast then being right: “Deny, deny, deny. That’s how you hit your numbers,” Day said.

Day reached a breaking point and became a whistleblower. I never met her; she joined the company around the time I left, but I know what she told the reporters was far from unique.

Reading the story brought back the nightmare a family experienced when a Cigna medical director denied coverage for a liver transplant for 17-year-old Nataline Sarkysian. Bad publicity around that case became so intense Cigna eventually caved and agreed to cover the procedure. But that reversal came several days after a Cigna medical director in Pittsburgh–2,500 miles from the Los Angeles hospital where Nataline was a patient–refused to authorize coverage for the transplant. Nataline grew sicker with each passing day and died five hours after Cigna’s change of heart.

That was the final straw for me and contributed more than anything else to my decision to walk away from my career and become a whistleblower myself, before Congress, in 2009.

I will write more in the coming days about the increasingly offshored death panels Big Insurance operates and why you should care. In the meantime, I implore you to read the harrowing investigative reporting by Patrick Rucker, David Armstrong, Maya Miller and reporters at The Capitol Forum.

But here are a few excerpts:

Some of (Day’s) colleagues quickly denied requests to keep pace, she said. All a Cigna doctor had to do was cut and paste the denial language that the nurse had prepared and quickly move on to the next case, Day said. This was so common, she said and another former medical director said, that people inside Cigna had a term for these kinds of speedy decisions: “click and close.”

“Deny, deny, deny. That’s how you hit your numbers,” said Day, who worked for Cigna until the late spring of 2022. “If you take a breath or think about any of these cases, you’re going to fall behind.”

During Day’s final years at Cigna, the company meticulously tracked the output of its medical directors on a monthly dashboard. Cigna shared this spreadsheet with more than 70 of its doctors, allowing them to compare their tally of cases with those of their peers. Day and two other former medical directors said the dashboard sent a message loud and clear: Cigna valued speed…One of Day’s managers in a written performance evaluation called the spreadsheet the “productivity dashboard.”

The early 2022 dashboards listed a handle time of four minutes for a prior authorization. The bulk of drug requests were to be decided in two to five minutes. Hospital discharge decisions were supposed to take four and a half minutes.

I want to personally thank Dr. Day for her courage in sharing what she saw and was told to do by her bosses, and I want to encourage the many others who work inside Big Insurance who were also pressured like she was to do whatever it takes–regardless of the harm to patients–to help the company achieve Wall Street’s profit expectations.

I work informally with The Signals Network, which exists to protect and support whistleblowers across industries and around the world. (I was on a Signals Network panel earlier this year, along with whistleblowers from Uber and Twitter, at the Knight Foundation’s annual Media Forum in Miami.) Would-be whistleblowers can communicate with the folks at the Signals Network confidentially and securely. And I would be happy to talk with anyone interested in stepping forward.