As PoliticoPro reported this week, the Consumer Financial Protection Bureau (CFPB) finalized a long-awaited rule that would bar medical debt from appearing on Americans' credit reports. This single action could wipe $49 billion in debt from the credit reports of 15 million people, offering relief to individuals and families that have had their financial futures derailed by the unforgiving realities of our health care system. If you’ve ever struggled with medical debt—or know someone who has—this is a moment worth celebrating.

This progress did not happen in a vacuum. Addressing the medical debt crisis has been a growing priority for policymakers, patients and organizations like Be A Hero, Undue Medical Debt and the Lower Out-of-Pockets (LOOP NOW) Coalition, which I lead.

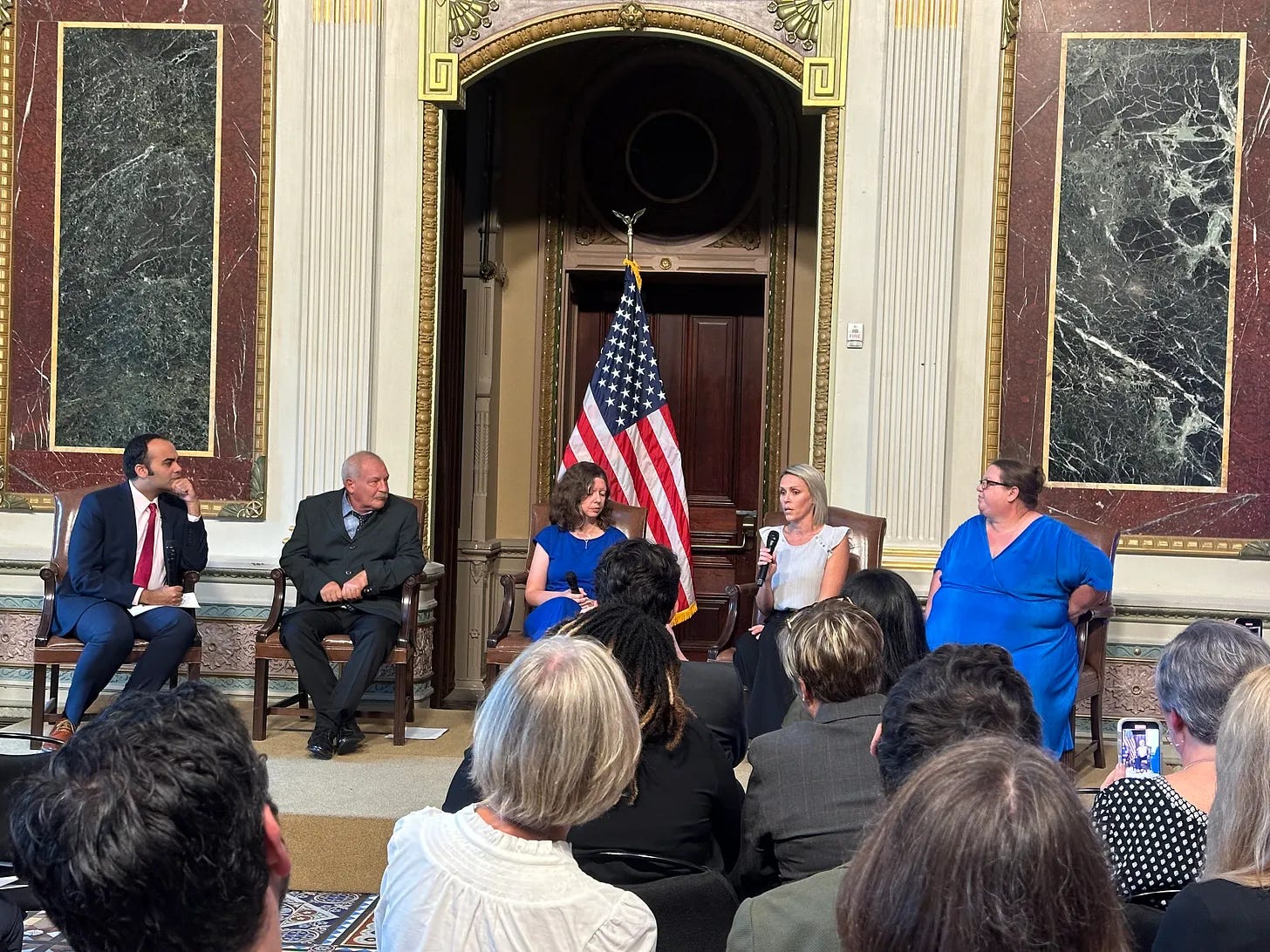

My team and I, through LOOP NOW, had the honor of helping facilitate a White House event in which Vice President Harris and CFPB Director Rohit Chopra laid out the administration’s plans to address the crisis. That event wasn’t just about policies — it was about amplifying the stories of people like Lindsay, a single mother saddled with $50,000 in medical debt after her insurer denied coverage for her child’s life-saving brain surgery.

The CFPB’s new rule is an extension of that work, building on measures announced at the White House. At the time, CFPB had already issued guidance to crack down on improper medical debt collections and published resources to help consumers navigate disputes over medical bills. These actions, combined with the agency’s recent final rule, represent a clear message: medical debt should not be a life sentence.

This new rule closes a “special carveout” that has long allowed debt collectors to weaponize medical debt. For years, collectors have exploited inaccuracies in the system to coerce payments for bills that patients may not even owe.

Still, we can’t ignore the precarious timing of this achievement. As PoliticoPro reported, Republicans have already signaled opposition to the rule, calling it a threat to credit report accuracy.

While this rule will provide immediate relief, the underlying causes of medical debt remain unresolved. As I wrote in HEALTH CARE un-covered, the structural flaws in our health care system — like wallet-burning out-of-pocket costs and insurers that deny coverage for critical care — continue to fuel this crisis. Until we address those root causes, families like Lindsay’s will remain vulnerable.

The CFPB’s new rule is only one piece of a larger puzzle. Millions of Americans are counting on advocates and policymakers to keep pushing — not just to alleviate the current medical debt crisis but to prevent it from happening in the future.

this is significant in permitting debtors to access resources but does not resolve the debt itself, our healthcare industry remains broken, keep up the good work... we have a long way to go..

This is a great first step. I believe it's also unconscionable that billing departments do not tell people that they can apply for financial assistance, opting instead to put a person on a payment plan or send them to collections.