A CLOSER LOOK: The Mid Year Earnings of 7 Big For-Profit Insurance Companies

The country's biggest insurers took in $620.6 billion in revenue, much of it from taxpayers.

BIG INSURANCE

MID 2022 SNAPSHOT

Key Takeaways:

Three insurers’ PBMs (Cigna, CVS/Aetna, UnitedHealth) control 80% of the pharmacy benefit market.

Cigna and CVS now get more revenue from their PBMs than their health plans and stores (CVS).

The Big 7 for-profit insurers control 69% of the Medicare Advantage market.

85% of all new Medicare Advantage enrollment went to for-profit insurers in 2022.

99.3% of UnitedHealth’s enrollment growth has been in government programs over the past 10 years.

The Big 7 for-profit health insurers made $43.8 billion in profits, and

They took in $620.6 billion in revenue, much of it from taxpayers.

53% of all Medicaid beneficiaries are now enrolled in health plans managed by the Big 7.

Meanwhile…

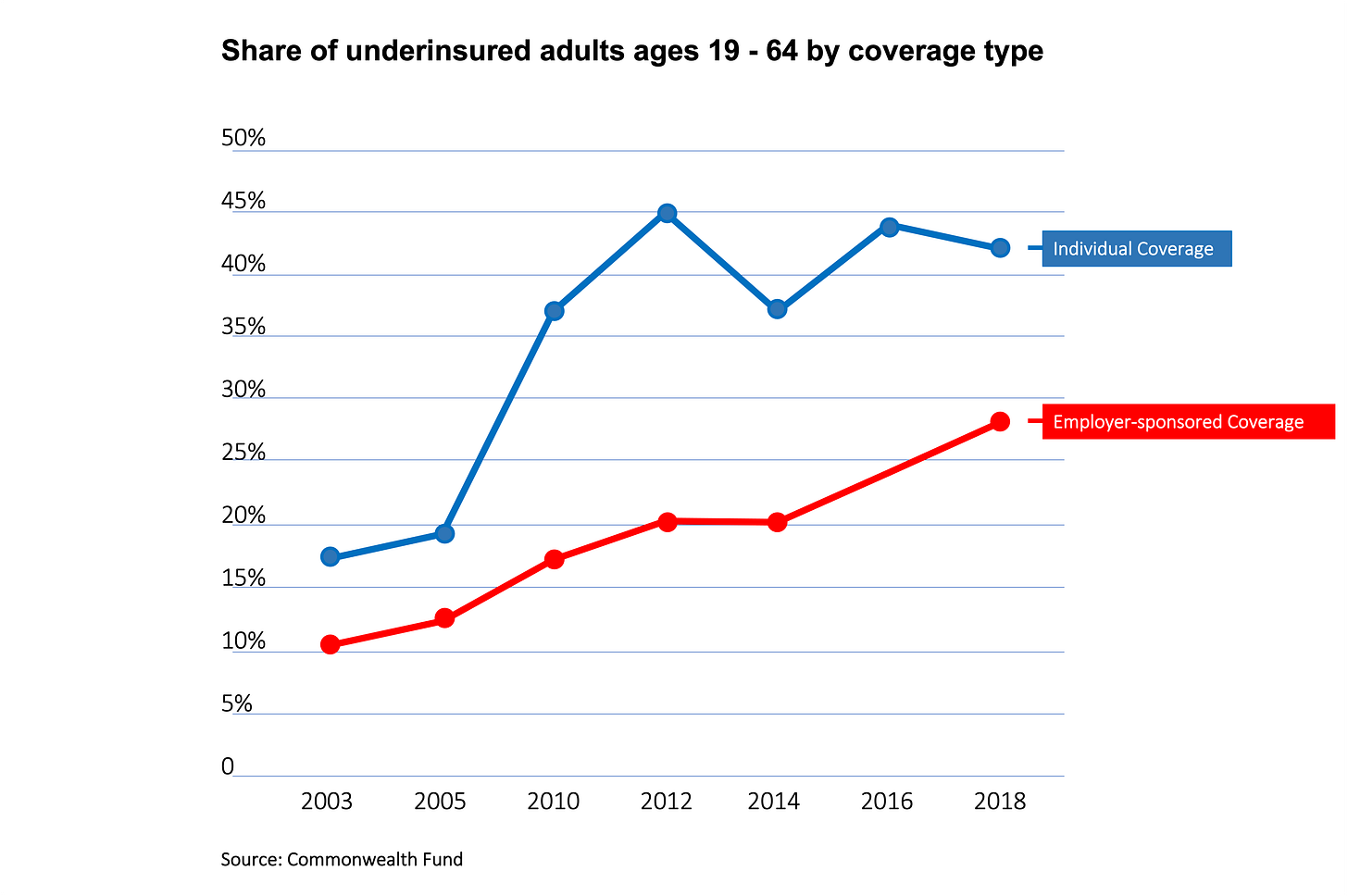

43.4% of U.S. adults between 19-64 are underinsured primarily because of insurers’ out-of-pockets demands.

As the Big 7’s profits skyrocket, so does the number of functionally uninsured (underinsured) Americans:

And so does the cost of health insurance:

UNITEDHEALTH GROUP

In 2012, UnitedHealth Group was #22 on the Fortune 500 list of U.S. companies. Today it is #5.

45.8 million: The number of Americans enrolled in a public or private health plan managed by UnitedHealth at the end of 2Q22. That’s up almost 10 million from 2Q12. But…

99.3%: How much of the company health plan enrollment growth has come from taxpayer-financed or supported government programs, Medicare Advantage in particular, over the past decade.

2.7X: How much UnitedHealth’s Medicare Advantage enrollment grew between 2Q12 and 2Q22, from 2.6 million to almost 7 million.

$80.3 billion: UnitedHealth’s total revenues in 2Q22, up 294% from $27.3 billion in 2Q12.

323%: How much UnitedHealth’s operating profits have increased between 2Q12 and 2Q22, from $2.2 billion in 2Q12 to $7.1 billion in 2Q22.

8.9%: UnitedHealth’s operating profit margin in 2Q22, compared to 8.2% in 2Q12.

10.3X: How much Optum’s profits increased between 2Q12 and 2Q22, from $320 million to $3.3 billion. Optum encompasses UnitedHealth’s PBM and clinical practices and is the company’s fastest-growing division.

8.9%: UnitedHealth’s consolidated operating profit margin.

Of note: In addition to operating one of the country’s largest PBMs, UnitedHealth is also now the largest employer of physicians in the United States. More than 50,000 doctors work for the company.

CVS HEALTH/ AETNA

In 2012, CVS was #18 on the Fortune 500 list of U.S. companies. Today it is #4.

46%: The percentage of CVS’s total revenues generated by its PBM in 2Q22.

26% and 29%: The percentage of revenues generated by the company’s health plans and retail stores.

7.3X: How much Aetna’s Medicare Advantage enrollment increased between 2Q12 and 2Q22.

2.4X: How much Aetna’s Medicaid enrollment increased between 2Q12 and 2Q22.

800K: How much Aetna’s commercial enrollment increased between 2Q12 and 2Q22.

$10 billion: How much CVS is spending this year to buy back shares of its own stock.

Of note: Four days after beating Wall Street’s profit expectations for 2Q22, CVS hired John Legend to perform at a private party for company leaders at Disney World.

CIGNA

Over the past 10 years, Cigna has morphed from a health and disability insurance company to a PBM that also operates health plans.

0-70%: The change in the percentage of Cigna’s total revenues from pharmacy operations between 2Q12 and 2Q22.

$31.9 billion: The revenues from Cigna’s Express Scripts/Evernorth pharmacy operations.

$13.2 billion: The revenues from Cigna’s health plan operations in 2Q12, up from $5 billion in 2Q12.

4.6X: The company’s profit growth between 2Q12 and 2Q22, from $434 million to $2 billion.

3.8 million: The number of additional people enrolled in Cigna’s U.S. health plans in 2Q22 compared to 2Q12.

3X: Enrollment growth in Cigna’s Medicare and Medicaid plans between 2Q12 and 2Q22.

80.7%: The percentage of U.S. health plan revenue Cigna paid for medical care in 2Q22, down from 84.4% in 2Q21.

Of note: During the first six months of 2022, Cigna repurchased 9.7 million shares of common stock for approximately $2.3 billion. “Additionally, in July 2022, the Company received an initial delivery of 10.4 million shares of our common stock in accordance with the Accelerated Share Repurchase Agreements announced in June.”

ELEVANCE

Elevance, which was WellPoint before it became Anthem (in 2014) before it became Elevance (in 2022), owns for-profit Blue Cross and Blue Shield companies in 14 states.

62%: The percentage of total revenues generated by Elevance’s Medicare Advantage and Medicaid business during the first six months of 2022.

27%: The percentage of total revenues generated by Elevance’s private paying individual and group (commercial) customers.

5.9X: How much Elevance’s Medicaid enrollment grew between 2Q12 and 2Q22.

87%: The company’s medical loss ratio for 2Q22, up from 86.8% in 1Q22 and 85.4% in 2Q12.

7.62%: How much Elevance’s stock dropped in value in one day after the company reported spending more on medical care in 2Q22 than investors had expected.

Of note: Elevance spent $624 million buying back 1.3 million shares of its own stock during 2Q22.

CENTENE

Centene is the biggest Medicaid player by far among the Big 7. It now manages Medicaid plans in 29 states.

6.4X: How much Centene’s Medicaid membership increased between the second quarter of 2012 and the same quarter in 2022, from 2.4 million to 15.4 million.

17.1X: How much Centene’s revenues have increased over the past decade, from $2.1 billion in 2Q12 to $35.9 billion in 2Q22. The vast majority came from taxpayer-financed or subsidized Medicaid, Medicare Advantage, Tricare, and ACA marketplace plans.

$3 billion: How much Centene made in profits in 2021, up from $190.3 million in 2011.

86.7%: How much Centene paid for medical care as a percentage of revenues last quarter, way down from 92.9% in 2Q12.

HUMANA

Humana was a nursing home company before it became a hospital company (in 1972) before it became a managed care company (in 1993). Now it is getting back into health care delivery.

4.6X: How much more in profits the company made during the first six months of 2022 than in the same period in 2012, from $604 million to $2.8 billion.

2.4X: How much more the company collected in revenues in the first six months of 2022 than in the same period in 2012, from $19.9 billion to $47.8 billion.

200K: How much enrollment in the company’s commercial (private paying) declined between 2Q21 and 2Q22.

2.7X: How much enrollment in Humana’s Medicare Advantage plans increased between 2Q12 and 2Q22.

1.9X: How much enrollment in Humana’s Medicare and military plans increased between 2Q12 and 2Q22.

Of note: Humana said in July it will split itself into two units: health insurance services and CenterWell, the company's care delivery and healthcare services arm. It announced in August its plan to boost its Medicaid business by buying a Wisconsin-based managed care company.

MOLINA

Molina has grown from a small Medicaid managed care company into a one with 5.1 million people enrolled in its health plans in 19 states.

$37 million: How much Molina lost in 2Q12.

$600 million: How much the company made in profits in 2Q22.

94%: How much of the company’s health plan enrollment is in government programs, primarily Medicaid.

200K+: The number of private-paying commercial members the company lost between 2Q21 and 2Q22.

Of note: 100% of Molina’s enrollment growth between 2Q21 and 2Q22 was in Medicaid and Medicare Advantage. It’s ACA marketplace enrollment declined from 638,000 to 357,000.